Lexer Markets

a hybrid liquidity protocol for diverse trading

Project: Lexer Markets

Category: Perpetual and Spot Exchange

Launching: Q1 2023

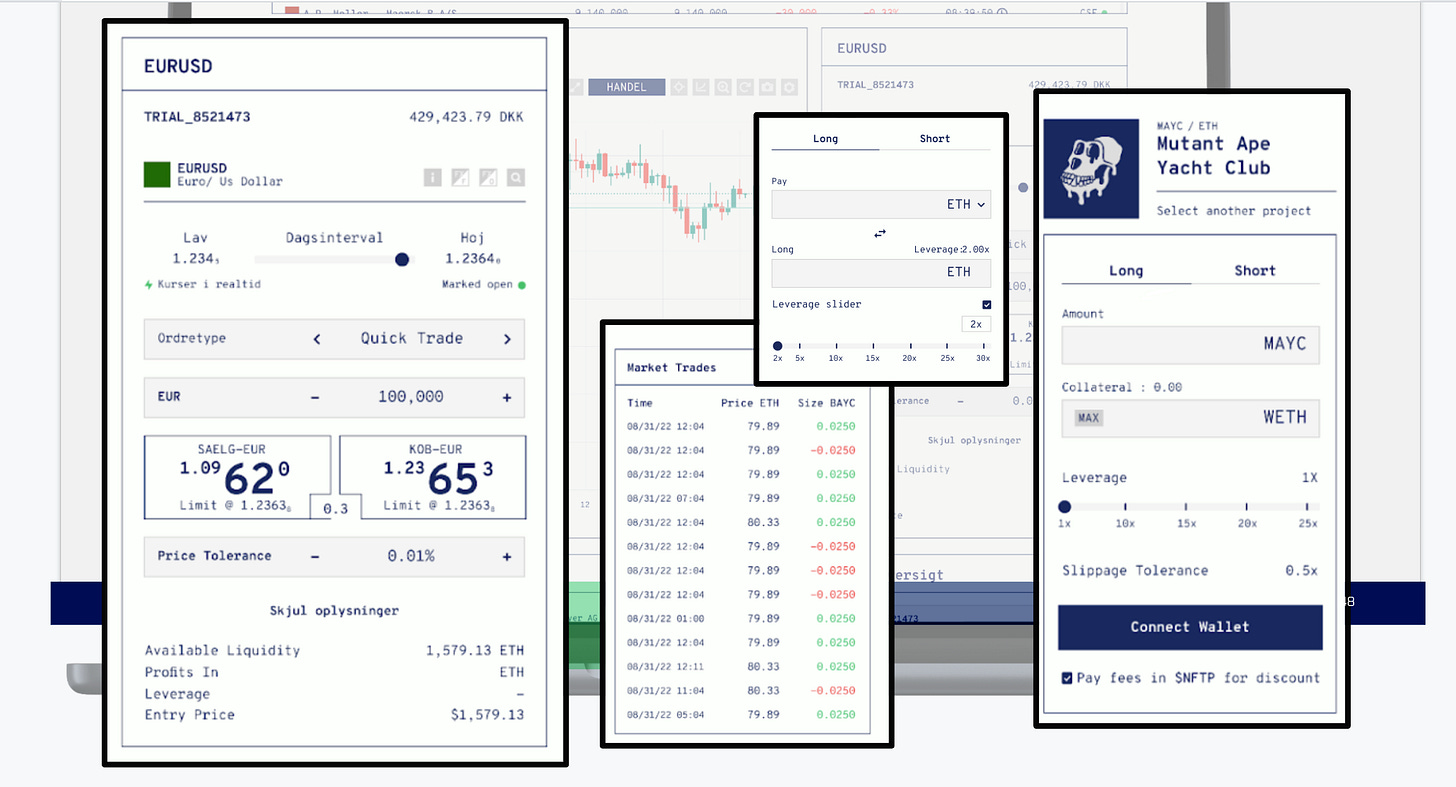

Paper Trading Competition: Round 2 Starting February 16, 2023

Overview

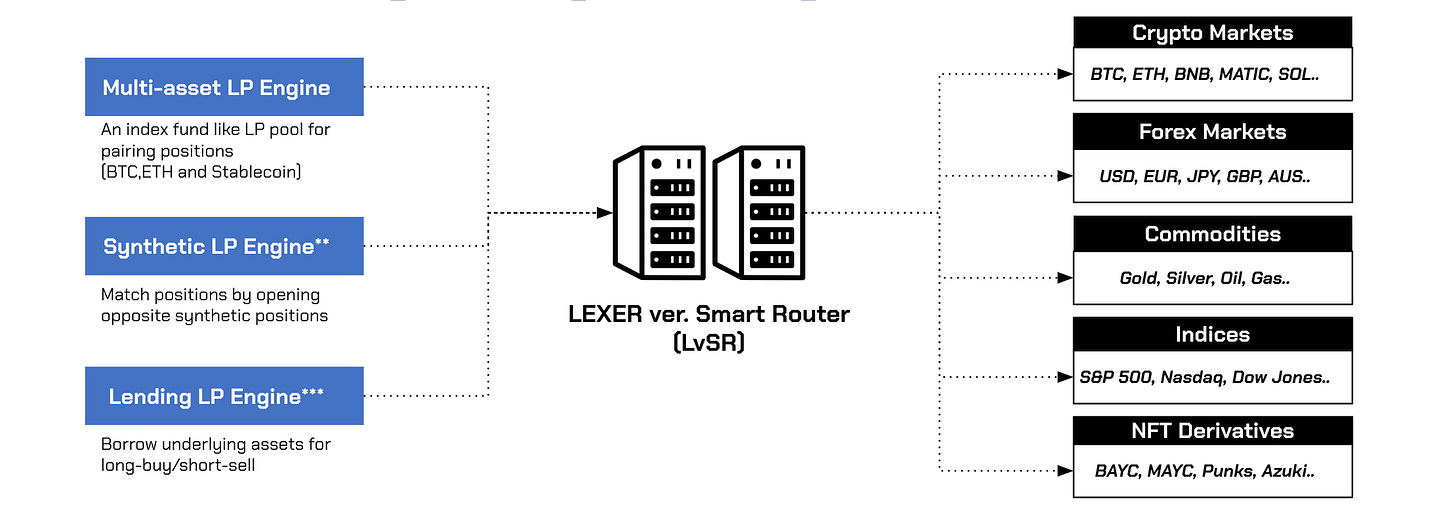

Lexer is a decentralized perpetual and spot exchange offering a hybrid liquidity mechanism to enable trading for a vast range of markets. These markets include Crypto, Forex, NFT derivatives, commodity and equity indices. Lexer uses a smart router and oracle based settlement algorithm to match trades. Certain trades will flow to different liquidity pools depending on the asset being traded. Combining these liquidity sources allows Lexer to offer a diverse set of products for traders.

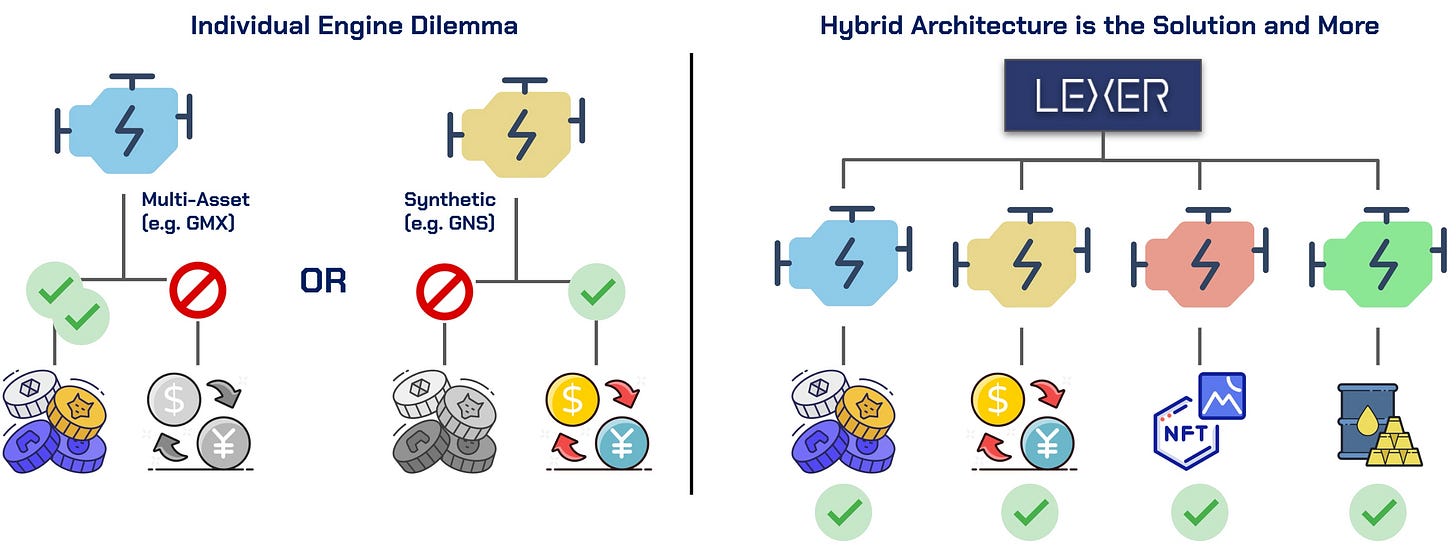

Hybrid Liquidity Engine

Lexer offers two different pools for its source of trade liquidity. The first is a multi-asset backed pool, which is similar to GMX’s GLP. The pool consists of large cap cryptocurrencies like Bitcoin and Ethereum as well as stablecoins. A second pool, called their synthetic pool, contains only stablecoins. They view both being good for different use cases. The multi-asset pools back trades for large cryptocurrencies like BTC and ETH, and synthetic pools for NFT derivatives, Forex, equity indices and smaller market cap coins.

How Multi-Asset Pools Work

Liquidity providers deposit native tokens (BTC, ETH, USDC, etc) into a pool. Traders can open positions against those coins natively. If a user is long BTC, they must use BTC as collateral. If they are short BTC, they use USDC as collateral. The protocol will automatically convert any collateral a trader has to what is required. If the trader wins, the pool pays the profits out in the native token (BTC from the example above). If the trader loses, their collateral is transferred to the pool.

Synthetic Liquidity Engine

This pool allows liquidity providers to deposit only USDC. Traders can go long or short other markets like Forex, commodities, NFT derivatives or equity indices. The pool acts as the counterparty and profit is paid out to winning traders in USDC. If a trader loses, their collateral in the form of USDC is transferred to the pool.

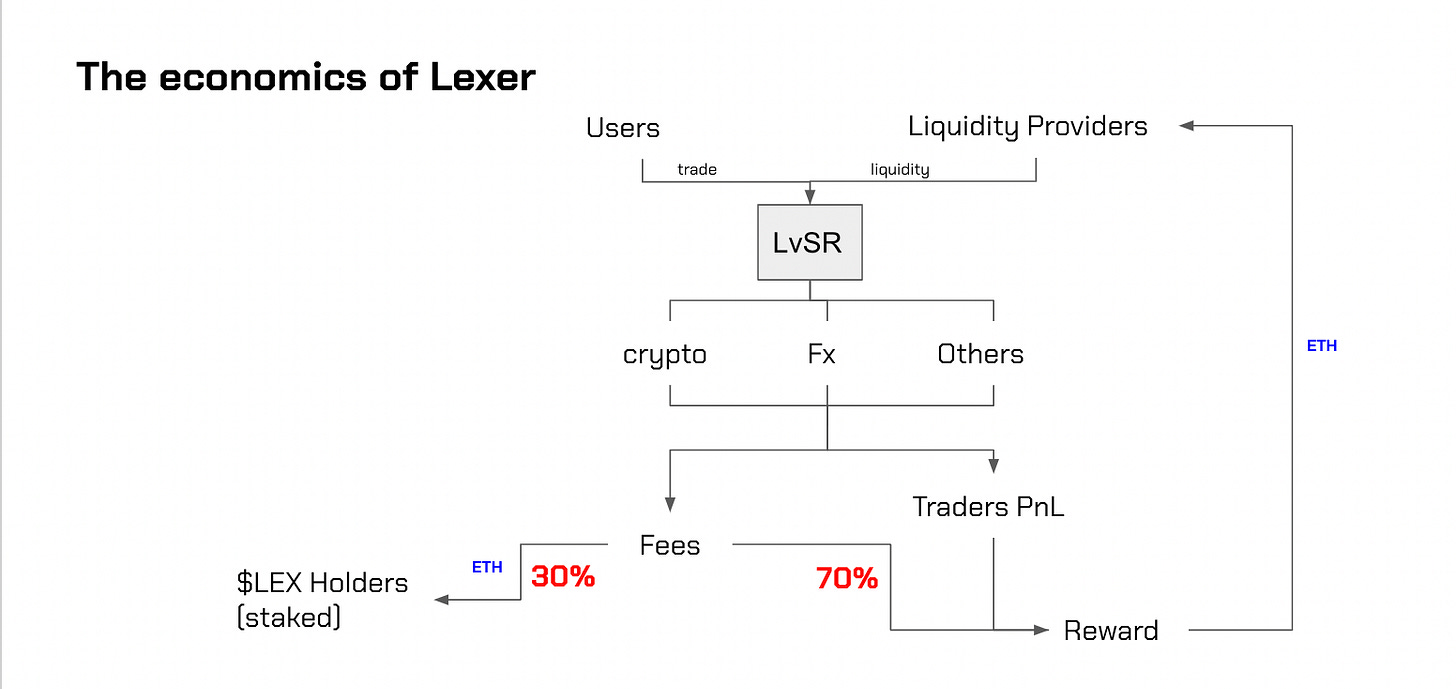

*Worth noting that these pools are isolated. The liquidity providers in the synthetic pool bear no risk from the traders trading out of the multi-asset pool. Regardless of the outcome, 70% fees generated from these pools go to liquidity providers. The remaining 30% go to stakers of the LEX token. All fees are paid out in ETH.

Lending Liquidity Engine

The purpose of this pool is to allow for leverage. Lenders may create their own lending pools for a trading token. By depositing both the native token and USDC, it allows traders liquidity to borrow against. If the trader wants leverage for a long they borrow USDC and swap into the desired token on the DEX. If they want to short, they could borrow the native coin (ex. ETH), and sell for USDC, hoping to rebuy at a lower rate later.

Oracle Based Pricing

Lexer uses an ‘on-demand decentralized oracle network’ (DON) for obtaining live and accurate price feeds. It aggregates the spot price of leading exchanges, takes the median and removes outliers. It also uses a keeper node to cross check prices with a Chainlink oracle’s price. If there is any deviation, both are submitted and used for price execution.

Here is an explanation from the whitepaper of a scenario where both prices are submitted:

“For example for ETH/USD, the deviation threshold would be 0.05%, if the price data comes out at $1000 and the Chainlink price at $1010, both prices will be sent to the blockchain. When opening a long position, the higher price is used and when closing the lower price is used, for short positions, the lower price is used when opening and the higher price is used for closing.”

Fees

Spot Swap fee: 0.2% - 0.8%

Execution fee (opening and closing): 0.06% of position size

Limit Order Fee: 0.02% Fee

Borrow Fee: Charged based off of utilization rate. Depends how much of the asset is utilized in the LP pool.

They also include a “spread fee” to prevent toxic arbitrage and manipulation.

Smart Router

The smart router is essentially the way Lexer routes the trades to each LP pool. The asset being traded determines the route to liquidity. Large cap cryptocurrencies like BTC/ETH will be routed to the multi-asset engine. If trading Gold or the Euro, it will route the trade to the Synthetic LP engine.

Tokenomics

LEX - the governance and utility token. Stake LEX to earn 30% of protocol fees, distributed in ETH.

veLEX - the token that represents staked LEX. While normally ‘ve’ tokens are locked for some duration, I confirmed in the discord these tokens would be able to be freely unstaked.

Currently there are no released tokenomics for Lexer with regards to supply cap and distribution.

Paper Trading Competition Airdrop

Lexer hosted round one of its paper trading competition. It ran from January 9 to January 20, 2023. Users minted paper tokens and chose between 3 teams (Team Camelot, Team Raccoon and Team Rodeo).

Final scores were based on realized P&L over the competition. There were 500,000 rLEX tokens up for grabs, and the top 3 prizes were as follows:

1st place: 40,000 rLEX

2nd place: 30,000 rLEX

3rd place 15,000 rLEX

Various rLEX rewards for placing 4th to 200th

*Note - I confirmed in discord that rLEX tokens would be convertible to LEX tokens once the platform goes live.

There were also team prizes, which included:

1st place team: 15% fee discount

2nd place team: 10% fee discount

3rd place team: 5% fee discount

These discounts are valid for 3 months and go live when Lexer launches.

They are having round 2 of the paper trading competition beginning on February 16, 2023. Register here if interested (and make sure to join team Primapes!).

Conclusion

Lexer joins the Arbitrum perpetual dex war with a wide range of product offerings for traders. Their hybrid liquidity engine offers liquidity providers different options of risk to suite their needs. Like other comparison projects, the success will depend on the flywheel of attracting liquidity. The more available liquidity, the more volume Lexer can potentially capture, and the more fees liquidity providers can generate. One interesting aspect is the potential to offer NFT derivative trading, which is still a nascent market. Make sure to sign up to their paper trading competition and perhaps win some LEX tokens!