Incase you missed the community call for Camelot on Thursday, February 16, 2023 I decided to take some notes and summarize it. The call included a discussion between Iron Boots and core developer Myrddin.

If you’d like a more in depth review on Camelot and its features, you can check out a piece I wrote about them here.

Discussion on Recent Growth and Metrics

Highlighted that TVL has grown to 65M

Daily volume has recently been around 25M

Team’s approach has remained consistent - goal is to slowly onboard new partners in the Arbitrum ecosystem

They continued to reiterate their focus for listing Arbitrum native tokens (rather than competing vs Uniswap on ETH/USDC)

Strategy has been working well - there has been a healthy growth of development in Arbitrum, and Camelot offers a compelling package for them to list/partner with them

Noted that some projects (Umami, dSquared) migrated just for the tech features, without any incentives

Camelots product offers a lot of value outside of emissions (nitro pools, spNFT’s, dynamic fees, etc) and protocols have been receptive to that

Myrddin noted that Uni V2 works well because there is complexities in managing a Uni V3 position - a lot of LP’s frequently lose money

They mentioned that their goal was not to just emit tokens for any pool just to obtain TVL

Wanted to focus on pools strategically - such as ones that had great volume/fees

Camelot has the second highest volume on ETH/USDC even while focusing on Arbitrum native protocols

Jones and Plutus moving their liquidity to Camelot is great since it attracts users to the frontend and could enhance more adoption

The different features of Camelot work well as users of the launchpad will explore Nitro pools/other projects trading on Camelot

Treasury

Common question that has come up in chat - if Camelot generates 100k in fees does that mean next epoch has huge rewards?

A: not necessarily - there is a correlation (rewards will increase) but Camelot wants to smooth out rewards over time to provide sustainable dividends in periods of high and low volumes

Myrddin notes that the amount in the dividends reward pool has grown from launch (Camelot generated 1.1M for dividends during launch and currently has more than that)

Initial idea was to spread that out over one year incase fees/volume were low, but the recent success has allowed them to expand dividend runway and still provide nice APR

When Camelot takes fees they are in LP tokens (for example VELA/ETH)

They unbind them and use some of the ETH/USDC/GRAIL to distribute fees to dividend pool

The partner tokens are used to slowly build treasury

Long term they want to generate additional yield via staking partner tokens (actively manage treasury)

Iron Boots jokes 'productive ecosystem focused treasury with real yield'

IB notes that while volume has been very strong, it is obviously variable and changes

However he is confident that they can sustain good volume with the upcoming suite of new launches (see list in launchpad section below)

Emissions

With recent price action Camelot has been able to manage emissions better

Rough estimation from Myrddin - he says Camelot is offering 4X LESS emissions than planned at this stage

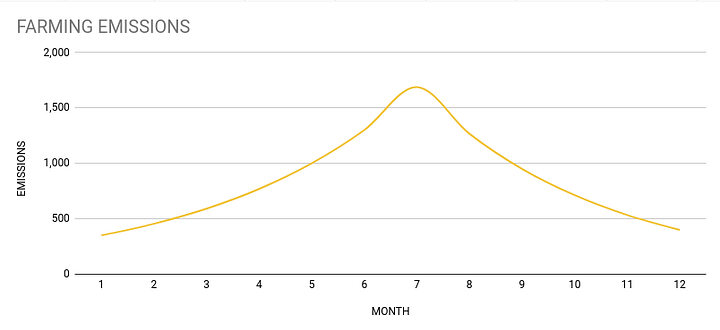

Initial idea was a bell curve - ramp up emissions in the first 6 months before tapering off

Since the large amount of emissions at this stage were not needed, it gives Camelot a huge opportunity in the future to target special campaigns if needed

One campaign could be the potential Arbitrum token

Myrddin teased that if there is an ARB token they could utilize the excess emissions to incentivize deep liquidity for it on Camelot

Lowering emissions while still capturing TVL and volume puts them in a great position and speaks to what projects think of the features

A lot of partners want to offer large emissions of their native token, but after consulting with Camelot they realize they do not need such aggressive initial emissions

IB notes that this is a large part of Camelots value (helping structure launches/liquidity/incentives)

Overall, Camelot has grown from $2M in protocol owned liquidity (POL) to around $15-16M and they earn about $30K in daily fees

Launchpad

Wide range of launches happening soon, including:

Nitro Cartel (live now), Factor DAO (Feb 20), Onchain Trade (Feb 27), JustBet (Mar 6), Halls of Olympia (Mar 13), Perpy (Mar 16)

Launchpad is currently permissioned but have the goal of it being permissionless

They began it as permissioned to see how it would work, what the demand was and to hear of any adjustments/feedback from teams

Currently getting ton of requests for launchpad (5-6 new tickets per day)

They do not want to act as the authority to validate what projects get onto launchpad - currently they’re just trying to ensure projects that launch have been seriously worked on/team seems dedicated

Will not make guarantees or endorsements about legitimacy

When launchpad is permissionless they will differentiate between roundtable partners and other projects just launching on the pad

There is plans to have a xGRAIL plugin for launchpad "soon - matter of weeks"

launchpad will still be open to all users (not just grail/xgrail holders)

Users will be able to allocate xgrail and get benefits from the projects launching

Benefits would vary depending on project launching

This would benefit other plugins as well as some would migrate from dividends/yieldbooster and enhance APR in those plugins

Team then discusses Nitro Cartel raising their cap on upcoming launch, their thoughts:

benefits of raising cap include a more fair launch (not allowing bots to buy up to the cap)

ultimately up to the market to decide what fair value is as everyone gets same price

majority of criticism has been that it reduces future demand

notes that uncapped launch did not negatively affect grail/neutra price action in long term

Bonds

plan is to release bond market with their partner Bond Protocol

Will be two markets: GRAIL and xGRAIL (note - these tokens are coming from the development fund)

Want to use proceeds to expand team (team is very lean at moment)

looking to recruit 2-3 new members

Link to twitter announcement here

Developer Alpha

Next immediate feature is the launchpad plugin (mentioned above)

Also mentioned a very big upgrade in March (both on contract and frontend side)

Front end will be totally revamped with main focus to simplify flow of creating LP’s and positions

They saw need to improve this as it can be very confusing for new users

Also exploring improving the speed of the app

No other real details on the big upgrade other than IB stating it will ‘blow your minds’

There are minor tokenomics updates at planned for end of February

Whole system working well but there are a few things (Yieldbooster specifically) they wish to improve

Also want to implement a few things to have POL grow a bit more

ETA on that is end of month (Feb)

Gauges have been mentioned by JonesDAO and IB made hidden hand proposal

The big upgrade in March does not include gauges

Gauges will be the focus after (Q2)

AMA questions

What are advantages of a treasury swap?

Main advantage is kind of a political move - shows a sign of commitment to another protocol

reinforces partnership

diversifies treasury

Anyone can say they’ll keep liquidity on your protocol but treasury swap shows commitment more concretely

When will the fees generated by the protocol be sufficient for covering the dividends?

Myrddin notes that Camelot is earning more than they are distributing currently

There was a comment about Hidden Hand?

IB reiterates that gauges are not coming until Q2

Any plans on turning idle treasury funds to productive use?

definitely something they want to do

was mentioned above - looking to stake the partner tokens they earn in fees for yield in the future and are exploring options to actively manage treasury

Is changing the volatile swap curve from x*y=k to curve v2 style on the roadmap?

IB is deliberately vague about roadmap

does not want to comment on that

IB: sometimes alpha best left unsaid

Will vesting xGRAIL holders get $TROVE airdrop?

Team is unsure, says it is best to check nitro cartel announcements

their recommendation was to use allocate to users that were holding xGRAIL or are allocated to dividends/yieldbooster, not for ones actively redeeming

Will there be any Plutus xGRAIL wrapper?

They are talking with them but that will take a bit of time

not current priority

Note: There is an Arbitrum AMA with Camelot (will announce when date confirmed) soon. It will be announced on the official Arbitrum twitter.

Thanks for reading!

Fantastic work ser. Very thorough.